Real Info About How To Tackle Debt

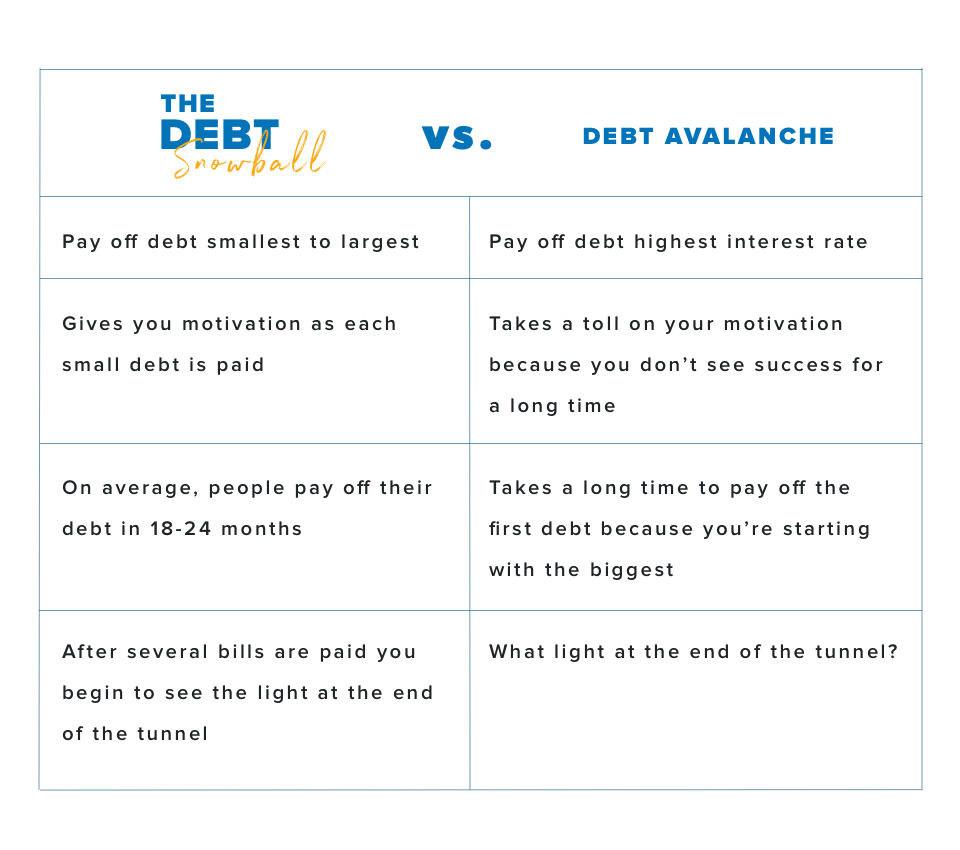

The snowball approach is seen as a more psychologically rewarding method.

How to tackle debt. Organizational debt is woven into the unwritten rules, the processes, and the functions. Debt settlement is when you negotiate with a creditor to settle your debt for less than you owe. However, while it may take some time, you absolutely can work to getting yourself out of debt.

Compare best offers from bbb a+ accredited companies. Ad get helpful advice and take control of your debts. Simply put, this ratio shows how many of one’s assets one will have to sell to.

Federal student loans typically have interest rates in the 4 percent to 6. Ad one low monthly payment. What is credit card debt.

Or even in the values or culture of your organization. Unbiased expert reviews & ratings. Tackling high interest credit card debt, whether the charges were for a necessity or indulgence, is a must, according to michael conway, ceo of conway wealth at summit.

Ad national debt relief is our highest rated debt consolidation company in every category. Calculate your combined debt and make a list of everything owed be honest about the debt you have, as this will help. Creditors will typically only settle debt that isn't current.

Know your options with aarp money map. Free to use for ages 18+ only. Create a list of shared.

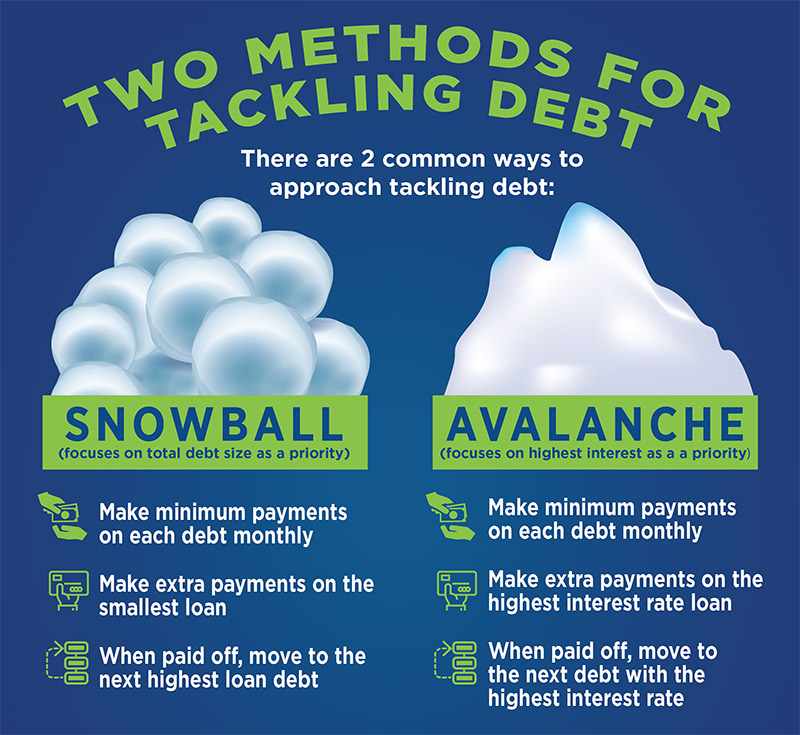

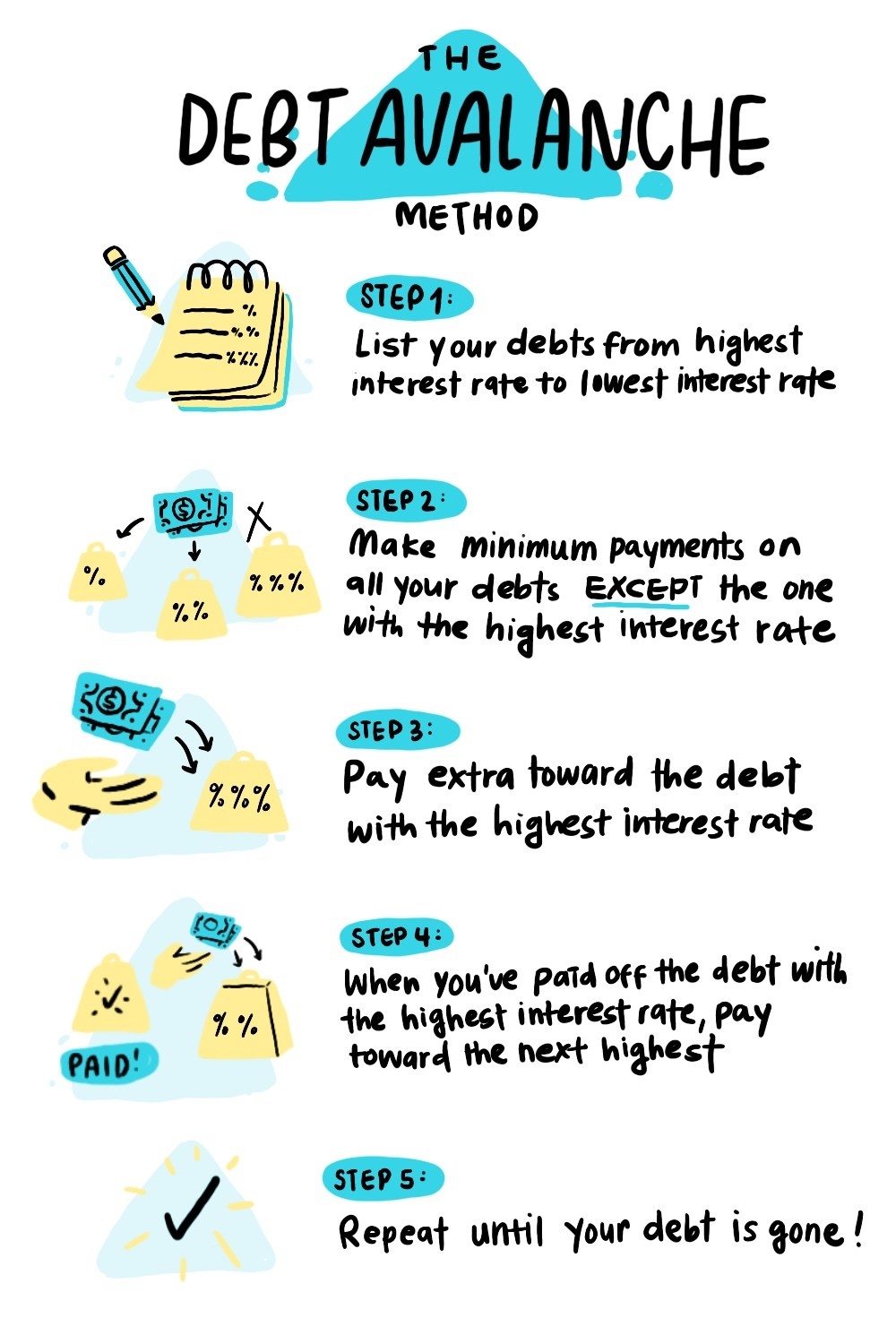

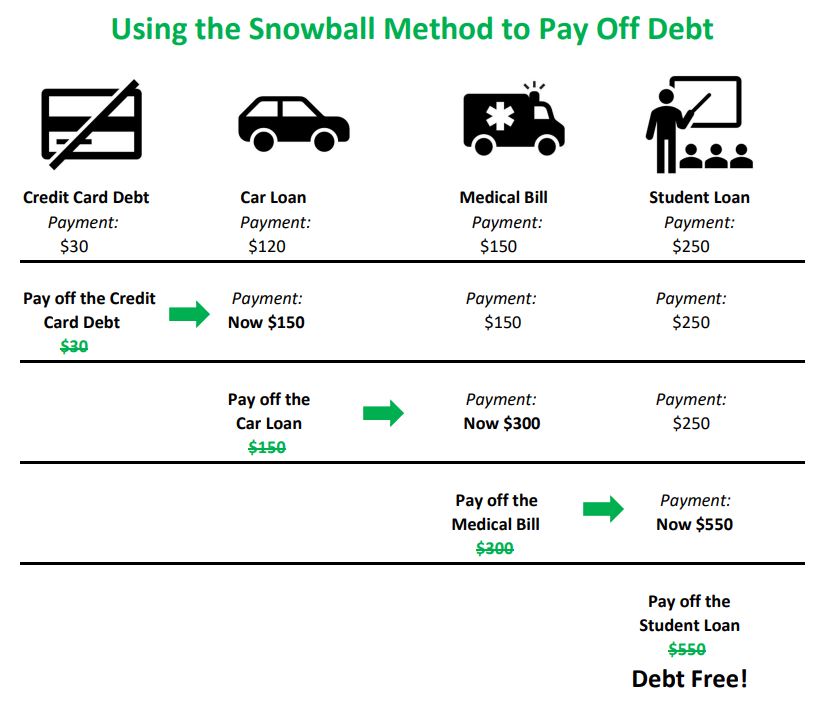

Here you tackle the smallest debt first and make the extra payments on them, moving up the ladder. Refinancing with a personal loan can get you a lower interest rate, so the debt will increase slower, allowing you to pay off more of the principal. Start by making the minimum payments on all of your debt each month take any surplus income you have and use it to pay extra principal on your smallest piece of debt once that first small.